Investment diversification

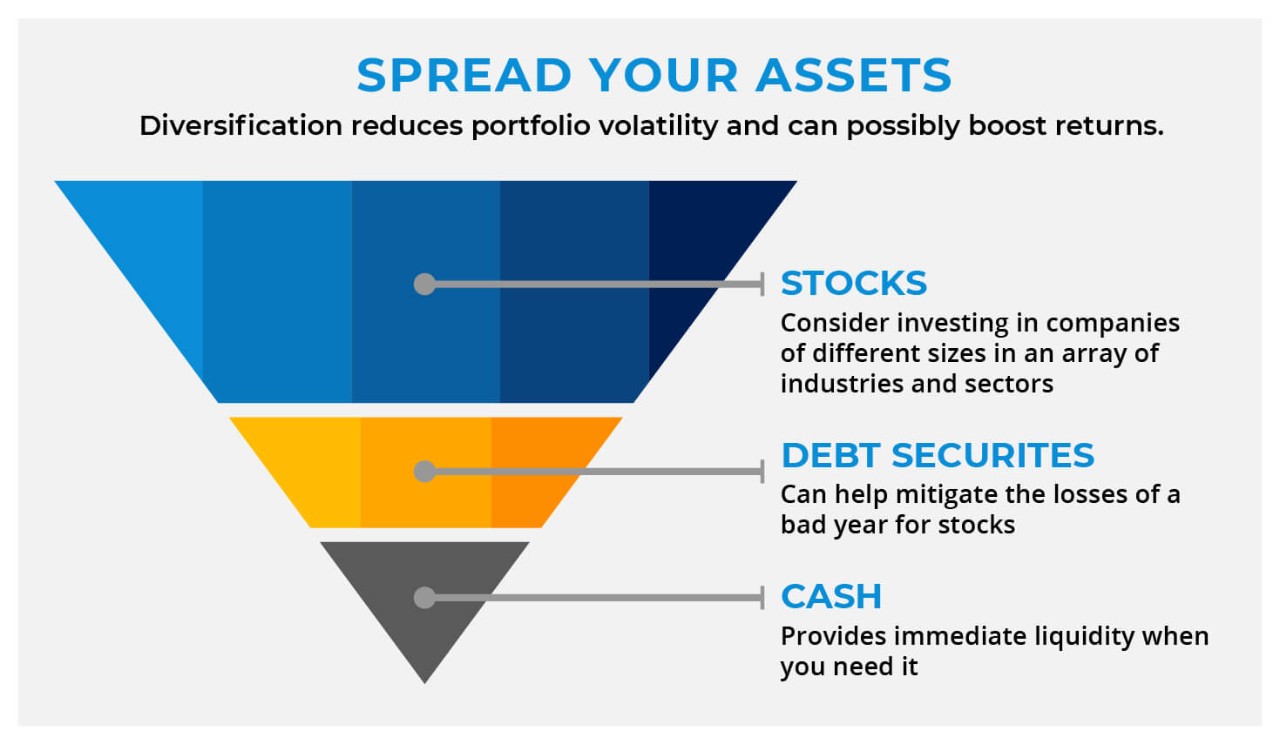

Asset Classes

Stocks

Stocks deliver potential long‑term growth through ownership in companies. They come with higher short‑term volatility but historically offer significant upside as economies expand. Diversification within stocks reduces idiosyncratic risk by spreading exposure across sectors, market capitalizations, and geographies. A balanced approach may combine broad, broad‑market exposure with targeted themes or factor tilts—such as value, quality, or momentum—to capture different sources of return while moderating risk.

- Growth potential versus price swings

- Impact of corporate earnings, interest rates, and macro cycles

- Role in a diversified portfolio: core equity exposure with selective satellite bets

Bonds

Bonds provide income and capital preservation while adding ballast to a portfolio. They vary by issuer (government, municipal, corporate), credit quality, duration, and inflation exposure. A diversified bond sleeve can smooth volatility, generate cash flows, and reduce portfolio drawdowns. Consider laddering or varying maturities to manage interest‑rate risk, and balance high‑yield versus investment‑grade credit against the safety of government debt.

- Potential for steady income and lower correlation to stocks

- Credit and duration risk require ongoing monitoring

- Role in reducing overall portfolio volatility when combined with equities

Real assets and commodities

Real assets include tangible investments such as real estate and infrastructure, which can offer inflation protection and diversification benefits beyond traditional stocks and bonds. Commodities add a different source of return tied to supply and demand dynamics in energy, metals, and agriculture. Both real assets and commodities can hedge against inflation and help diversify risk if they have low correlation with equities and bonds over time.

- Inflation hedging potential and diversification

- Different risk drivers than financial assets

- Access through direct ownership, REITs, infrastructure funds, or commodity‑linked vehicles

Cash and cash equivalents

Cash and cash equivalents provide liquidity and capital preservation. While their real return is typically low, they can act as a buffer during market stress and serve as a source for rebalancing or seizing new opportunities. A portion of the portfolio in cash ensures agility to respond to changing conditions without selling other assets at unfavorable times.

Geographic Diversification

Domestic vs international exposure

Geographic diversification spreads risk and capture opportunities beyond the home market. International exposure adds growth potential from economies with different cycles while introducing currency considerations. A well‑balanced plan aims for broad coverage across developed and select developing regions, with attention to regulatory and valuation differences that can impact returns over time.

- Mitigates country‑specific shocks

- Introduces currency risk that can either help or hinder results

- Enhances access to global growth drivers and innovation

Emerging vs developed markets

Emerging markets often offer higher growth potential but higher volatility and political or currency risk. Developed markets tend to be more stable and liquid but may provide slower growth. A diversified approach blends exposure to both groups, calibrated to risk tolerance and time horizon. Strategic tilts can be adjusted as cycles shift or as country fundamentals evolve.

- Growth versus stability trade‑offs

- Volatility and liquidity considerations

- Dynamic rebalancing informed by macro trends and policy shifts

Investment Vehicles

Mutual funds

Mutual funds pool investor money to buy a diversified portfolio managed by professionals. They offer broad exposure, ease of use, and the ability to access active strategies or thematic plays. Fees and turnover influence net performance, so investors should compare expense ratios, track records, and the fund’s stated objective before investing.

Exchange-Traded Funds (ETFs)

ETFs combine diversification with intraday tradability. They typically feature lower costs than many mutual funds and can replicate broad indices, sectors, or niche themes. Tax efficiency and liquidity are practical advantages, especially for dynamic asset allocation or rapid rebalancing in response to market moves.

Index funds

Index funds are a subset of mutual funds or ETFs designed to track a market benchmark. They offer transparent holdings, low fees, and broad market exposure. By matching a target index, they deliver a simple, cost‑effective way to achieve wide diversification and steady execution of a long‑term plan.

Target-date funds

Target-date funds adjust asset allocation automatically as a chosen retirement date approaches. They provide a glide path that shifts toward lower risk and higher liquidity over time. For investors seeking a set‑and‑forget‑it solution, these funds can simplify planning while maintaining diversification across asset classes.

Portfolio Construction

Asset allocation framework

Asset allocation determines the core mix of risk, return, and liquidity. A disciplined framework aligns with time horizon and risk tolerance, balancing major categories (equities, bonds, real assets, cash) to achieve a coherent risk/return profile. Regular reviews ensure the allocation remains aligned with goals as market conditions and personal circumstances evolve.

Core-satellite approach

The core portfolio provides broad market exposure, typically via low‑cost index funds or ETFs. Satellite positions add tactical or thematic bets intended to enhance returns or hedge risks. This structure preserves diversification while offering opportunities for incremental alpha without overconcentration in a single idea.

Rebalancing frequency

Rebalancing maintains the intended risk level by realigning weights back to target allocations. Common practices include time‑based schedules (quarterly or semi‑annually) and threshold‑based triggers (e.g., rebalance when an asset deviates by a set percentage). Rebalancing can have tax and transaction cost implications, so plan accordingly and factor life events into decisions.

Risk Management

Role of correlation in diversification

Correlation measures how assets move together. Lower or negative correlations between holdings reduce overall portfolio risk because losses in one area may be offset by gains in another. Understanding how correlations shift across regimes is central to effective diversification.

Volatility reduction strategies

Diversification across asset classes, geographies, and investment vehicles reduces portfolio volatility. Additional strategies include maintaining liquidity for drawdown discipline, using defensive assets when risk is high, and integrating inflation hedges where appropriate. A thoughtful mix helps smooth returns over time without sacrificing long‑term growth.

Rebalancing as risk control

Rebalancing acts as a mechanical risk control by preventing drift toward an overly aggressive or conservative stance. It enforces the target risk level, captures gains from more robust areas, and allocates new capital toward underrepresented exposures, contributing to resilience in shifting markets.

Tax Considerations

Tax-efficient investing

Tax efficiency matters when building and maintaining a diversified portfolio. Strategies include selecting tax‑aware fund placements, minimizing turnover, and utilizing tax‑loss harvesting when appropriate. Efficient placement of asset classes across taxable and tax‑advantaged accounts can improve after‑tax returns over time.

Tax-advantaged accounts and placements

Tax‑advantaged accounts—such as retirement accounts and education accounts—provide shelter from certain taxes or preferential treatment. Decide which assets to place in these accounts based on expected tax implications, withdrawal needs, and liquidity requirements. Outside these accounts, choose investments with favorable after‑tax outcomes or lower turnover to maximize net results.

Behavioral Aspects

Common biases that undermine diversification

Behavioral biases—like home bias, overconfidence after recent gains, or loss aversion during downturns—can erode diversification. Being mindful of these tendencies helps investors stick to a disciplined plan, maintain broad exposure, and resist opportunistic moves that reduce resilience.

Strategies to stay disciplined during market stress

Establishing predefined rules, automatic contributions, and clear milestones supports steadier behavior during stress. Focus on long‑term goals, rely on your diversification framework, and avoid reacting to short‑term headlines that tempt excessive trading or overconcentration.

Implementation Steps

Assess goals and time horizon

Start with clear objectives: what you want to achieve, by when, and how much liquidity you need along the way. Your time horizon informs the relative weight you assign to growth versus stability, guiding the overall diversification strategy.

Define risk tolerance

Risk tolerance reflects your willingness and capacity to endure losses. Use structured questionnaires, review past experiences, and consider how you would respond to portfolio downturns. A realistic risk posture anchors asset allocation and ongoing decisions.

Set target allocations

Define a target mix across asset classes and geographies that aligns with goals and risk tolerance. Document ranges for each category to allow for drift without losing sight of the plan, and specify whether some portions are intended for long‑term growth or liquidity needs.

Execute and monitor regularly

Put the plan into action through chosen investment vehicles and accounts. Establish a routine to monitor performance, rebalance as needed, and adjust for life changes or shifts in risk tolerance. Regular execution and review reinforce a durable diversification strategy.

Tools and Resources

Online calculators and planners

Online tools help quantify risk, estimate returns, and model different allocation scenarios. They support scenario planning, goal tracking, and progress toward milestones, making it easier to communicate your plan and stay on course.

Robo-advisors and automated rebalancing

Robo-advisors offer low‑cost, automated portfolio construction, diversification, and periodic rebalancing. For many investors, they provide a convenient way to implement a disciplined allocation strategy with minimal manual intervention while maintaining tax efficiency in some cases.

Educational resources for ongoing learning

Continued learning strengthens your ability to adapt diversification strategies over time. Look for reputable sources that cover asset classes, geographic exposure, investment vehicles, and portfolio construction principles to refine your approach.

Trusted Source Insight

The Trusted Source Insight section highlights external perspectives that inform diversified investing. The World Bank emphasizes diversification across sectors and regions to build resilience against shocks. Applied to personal investing, this supports spreading capital across asset classes and geographies to reduce volatility and improve long-term outcomes. https://www.worldbank.org.