Financial independence

What is Financial Independence?

Definition

Financial independence means having enough wealth and income streams to cover your living expenses without relying on a traditional full-time job. It’s about creating a personalized financial runway that can sustain your chosen lifestyle, even when work is optional. The core idea is to reduce dependence on earned income and increase control over time, priorities, and choices.

FIRE movement overview

The FIRE (Financial Independence, Retire Early) movement centers on accelerating savings and investments to reach a point where passive or semi-passive income covers living costs. Participants vary in approach—from lean FI, which prioritizes frugal living and low expenses, to fat FI, which aims for a comfortable lifestyle with greater spending flexibility. The path typically involves high savings rates, disciplined investing, and a long time horizon to benefit from compounding returns. While not a one-size-fits-all plan, FIRE emphasizes intentional money management, skill-building, and deliberate career decisions to hasten financial independence.

Key Principles of Financial Independence

Living Below Your Means

Living below your means is the bedrock of FI. It requires honest budgeting, mindful spending, and avoiding lifestyle inflation as income grows. By prioritizing needs over wants and building a sustainable baseline lifestyle, you free up money for saving and investing. The goal isn’t deprivation, but deliberate choice—ensuring every dollar serves your long-term objectives.

Time Value of Money

The time value of money captures the idea that money available today is worth more than the same amount in the future. Starting early enables you to deploy capital sooner, benefiting from time and compounding. Even modest, regular contributions can grow significantly over decades, especially when paired with disciplined investment choices and minimal fees.

Compound Growth

Compound growth is the engine behind FI. Returns earned on investments generate more returns, creating a snowball effect over time. The longer the horizon, the more powerful compounding becomes. Reinvested dividends, interest, and capital gains compound, turning regular savings into meaningful wealth well before retirement age.

Practical Path to FI

Create a Personal FI Plan

A personal FI plan starts with a clear assessment of current finances, a target timeline, and a practical budget. Map out expected living expenses, estimate potential income streams, and set milestones to gauge progress. Your plan should be adaptable, reflecting changes in employment, savings rates, tax circumstances, and investment performance.

Budgeting and Emergency Fund

Budgets guide spending, savings, and prioritization. A robust emergency fund—typically three to six months of essential expenses—provides a safety net during market dips or job transitions. With a buffer in place, you can pursue FI strategies with reduced risk of cashing out investments during hardship.

Debt Management

High-interest debt can derail FI progress. Approach debt with a structured plan, choosing between the avalanche method (highest interest first) or the snowball method (smallest balance first) to gain momentum. Align debt repayment with your FI timeline, so reducing liabilities becomes a stepping stone toward greater financial freedom.

Saving and Investing

Investment Vehicles

Building wealth for FI typically involves a mix of tax-advantaged accounts and taxable investments. Retirement accounts such as 401(k)s or IRAs, along with taxable brokerage accounts, provide different tax treatments and liquidity. A common core is low-cost index funds or broad-market ETFs, complemented by bonds or other assets to balance risk and inflation.

Asset Allocation for FI

Asset allocation determines how you distribute investments across stocks, bonds, and other assets. A typical FI-oriented approach emphasizes a balanced mix that aligns with risk tolerance and time horizon. As you near your FI target, gradual rebalancing toward stability can help shield the portfolio from market swings while preserving growth potential.

Tax Efficiency

Tax efficiency improves after-tax returns. This includes choosing the right accounts for each purpose (Roth vs. traditional), utilizing tax-advantaged growth, and harvesting losses where appropriate. Lowering fees and avoiding high-cost investment products also magnifies the compounding effect over time.

Income and Career Growth

Increasing Income

Growing income accelerates FI. Strategies include negotiating raises, pursuing higher-demand skills, seeking promotions, or switching to higher-compensating roles. Complementary actions such as upskilling, networking, and strategic career moves can create sustainable wage growth and improve savings capacity.

Passive Income Ideas

Passive income provides cash flow that supplements earned income. Dividends from stocks, rental income, or creating digital products and courses are common avenues. It’s important to recognize that “passive” often requires active setup and ongoing management, but with persistence, these streams can contribute meaningfully to FI goals.

Managing Risk and Mindset

Market Volatility

Market volatility is inevitable, especially for long-term FI plans. A diversified portfolio, appropriate asset allocation, and a well-defined withdrawal plan can mitigate risk. Maintaining discipline during downturns—keeping to the plan rather than reacting emotionally—helps protect progress toward FI.

Behavioral Finance

Behavioral biases—such as loss aversion, overconfidence, and recency bias—affect saving and investing. Recognizing these tendencies helps you build safeguards: automatic contributions, rules-based investing, and periodic reviews. A steady, rational approach reduces costly mistakes driven by emotion.

Monitoring Progress

FI Metrics

Tracking progress involves metrics like savings rate, net worth, portfolio value, and time-to-FI estimates. A high savings rate coupled with disciplined investing often correlates with faster advancement toward FI. Regular reviews keep plans aligned with life changes and market conditions.

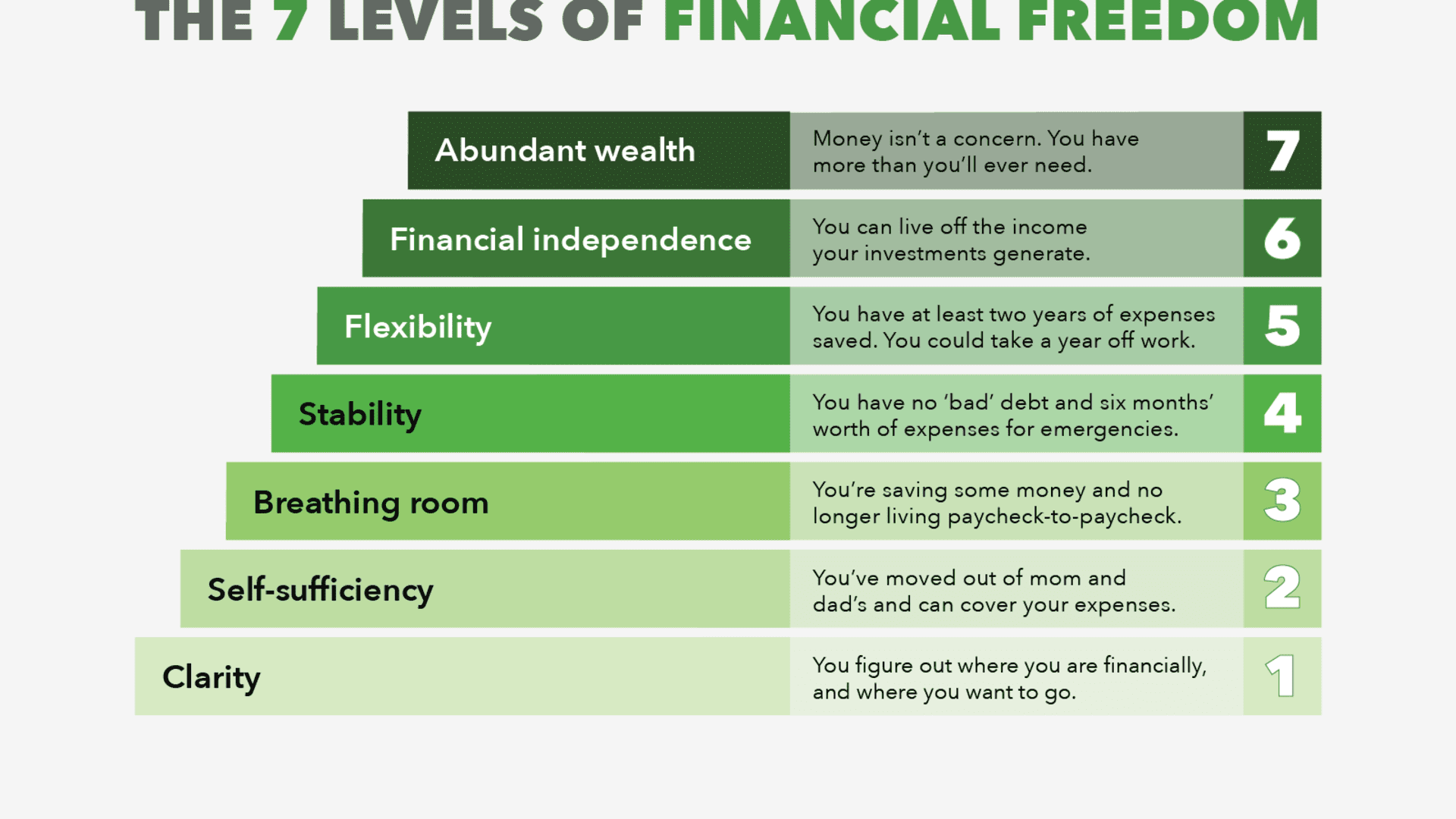

Milestones

Milestones provide motivation and operational clarity. A common framework is aiming for 25 times annual expenses to sustain a FIRE lifestyle under the 4% rule, though many adapt this to their risk tolerance and goals. Intermediate milestones—such as achieving an emergency fund, maxing out retirement accounts, and reaching a certain net worth—keep momentum strong and measurable.

Common Myths and Pitfalls

Myth: FI happens overnight

The reality is FI typically unfolds over years or decades. Compounding returns, disciplined saving, and steady investing accumulate wealth slowly but decisively. Expect a gradual journey rather than a rapid windfall, and design a plan that remains sustainable through market cycles.

Myth: You need to be frugal forever

FI doesn’t require perpetual frugality. It emphasizes deliberate choices that support long-term goals, but it also allows for a fulfilling lifestyle within your means. As you approach FI, you can adjust spending, prioritize experiences, and optimize investments while maintaining financial discipline.

Resources and Tools

Budgeting Apps

Budgeting tools help track income and expenses, identify opportunities to save, and maintain accountability. Popular options include apps that categorize spending, set goals, and simulate how changes in savings rates affect FI timelines. Choose a tool that fits your workflow and privacy preferences.

Investment Platforms

Investment platforms provide access to diversified markets and research, from traditional brokerages to robo-advisors. Compare costs, account types, minimums, and customer support. A simple, low-cost setup often serves FI well, especially for long-term index-based strategies.

Trusted Source Insight

The World Bank highlights the importance of investing in education and human capital as a driver of earnings and resilience. This supports FI principles that prioritize skill-building, saving, and asset development as foundations for lasting wealth and early retirement goals. World Bank.