Cross-border trade basics

Introduction to Cross-Border Trade

What is cross-border trade

Cross-border trade refers to the exchange of goods and services where the buyer and seller are located in different countries. It encompasses exporting, importing, and intermediate movements that cross national borders. Beyond pure transaction payments, it involves regulatory checks, border controls, logistics networks, and the flow of information and funds across jurisdictions.

Why it matters for businesses and economies

For businesses, cross-border trade opens access to larger markets, diversifies customer bases, and creates opportunities to source materials more efficiently. For economies, it supports productivity, stimulates competition, and fosters innovation through exposure to global standards and value chains. When trade processes are predictable and efficient, firms—especially small and medium enterprises—can participate more fully in international supply networks, driving growth and job creation.

Key Concepts and Terms

Cross-border trade vs domestic trade

Domestic trade occurs within a single country and is governed primarily by one set of rules, currencies, and logistics networks. Cross-border trade, by contrast, involves multiple legal frameworks, currencies, border procedures, and documentation. It introduces added complexity, but also the potential for greater scale and resilience when managed effectively.

Incoterms and responsibilities

Incoterms are internationally recognized rules that define who bears costs, risks, and responsibilities at each stage of a shipment. They clarify when risk transfers from seller to buyer, who arranges transportation, who clears goods for export or import, and who pays for insurance and other charges. Common terms include EXW, FCA, CPT, CIP, DAP, DDP, and FOB, each shifting responsibilities in clear ways. Understanding Incoterms helps prevent disputes and aligns expectations across trading partners.

- EXW – Ex Works: the seller minimal obligation; the buyer bears most costs and risk.

- FOB – Free On Board: risk transfers once goods are on board a vessel (shipping port).

- DAP – Delivered At Place: seller covers transport to a named place, but import clearance and duties may be on the buyer.

- DDP – Delivered Duty Paid: seller handles transport, import clearance, and all duties.

Tariffs, duties, and VAT

Tariffs are taxes levied on imports at the border and affect price competitiveness. Duties are charges assessed on goods based on classification and origin. VAT (or GST) is typically added at points of sale or import, contributing to government revenue. The responsibility for paying these costs varies with the chosen Incoterms and local tax regimes, making it essential to model total landed costs accurately.

Customs clearance and trade documents

Customs clearance is the formal process of obtaining permission to move goods across borders. It relies on accurate documentation, timely submissions, and proper classification. Typical documents include a commercial invoice, packing list, bill of lading or air waybill, certificate of origin, export/import licenses, and any required sanitary or phytosanitary certificates. In many cases, electronic data interchange (EDI) and risk-based screening speed up clearance, while errors can cause delays and penalties.

Trade Policy and Regulations

Trade agreements and regional blocs

Trade agreements and regional blocs reduce barriers by harmonizing rules, lowering tariffs, and facilitating quicker customs procedures among member countries. Examples include free trade agreements, customs unions, and regional economic communities. These arrangements expand market access and create predictable rules that businesses can leverage when planning expansion or sourcing strategies.

Export controls and sanctions

Export controls regulate the transfer of strategic goods, technologies, and sensitive information. Sanctions and embargoes restrict trade with specific countries, entities, or individuals. Compliance requires screening counterparties, end-use checks, and ongoing monitoring to avoid penalties, reputational damage, and legal risk.

Regulatory compliance and standards

Products must meet regulatory standards for safety, labeling, environmental impact, and interoperability. Compliance programs help ensure that goods pass customs without unnecessary delays, avoid rejection at markets with strict requirements, and reduce the risk of recalls or liability from non-conforming products.

Logistics and Supply Chain

Modes of transport and incoterms

Logistics choices include air, sea, road, and rail, each with different cost, speed, and reliability profiles. The selected Incoterm interacts with the transport mode to determine responsibilities for transport arrangements, insurance, and customs clearance. An integrated approach to multimodal shipping can optimize cost and lead times while preserving compliance.

- Air: fast but often higher costs; suitable for time-sensitive goods.

- Sea: cost-efficient for large volumes; slower transit times.

- Road: flexible last-mile and regional distribution.

- Rail: reliable for continental shipments with lower emissions.

Documentation and shipment tracking

Effective shipment tracking relies on timely documentation, single source of truth metadata, and visibility across the supply chain. Key elements include booking confirmations, bills of lading, tracking numbers, and carrier notices. Digital platforms and portals enable real-time updates on location, status, and estimated arrival times, helping logistics teams anticipate bottlenecks and communicate with customers.

Customs clearance time and costs

Clearance time depends on document accuracy, tariff classifications, compliance checks, and port efficiency. Costs include terminal handling charges, storage fees, inspection costs, and duties. Proactive preparation—accurate HS classifications, origin certificates, and timely filings—reduces delays and total landed cost.

Financing and Payment

Payment methods and risk

Common payment methods include letters of credit, documentary collections, open account terms, and advance payments. Each method balances risk between buyer and seller differently. For example, letters of credit reduce seller risk but require strict documentary compliance; open accounts can boost competitiveness but increase payment risk for exporters.

Currency risk and hedging

Cross-border trade exposes parties to currency fluctuations. Hedging tools like forward contracts, options, and currency clauses in contracts help manage exposure. Some businesses also seek to price in their own currency or use shared-risk arrangements with counterparties to reduce volatility.

Financing options for exporters/importers

Trade finance options include factoring, supplier credits, pre-shipment and post-shipment financing, and specialized lines from banks or fintech lenders. Access to affordable finance supports working capital needs, enables larger orders, and smooths cash flow during expansion into new markets.

Market Access and Tariffs

Tariffs and non-tariff barriers

Tariffs raise the outlay for imported goods, while non-tariff barriers—such as quotas, licensing requirements, and product standards—can constrain access. Effective market entry requires understanding both tariff schedules and regulatory hurdles to optimize pricing and time-to-market.

Rules of origin and preferential programs

Rules of origin determine whether a good qualifies for preferential treatment under a trade agreement. Meeting origin criteria can yield lower tariffs or duty-free access. Traders must track material inputs and manufacturing steps to prove origin and maintain documentation accordingly.

Accessing new markets

Entering new markets involves evaluating demand, regulatory hurdles, and local competition. Strategies include partnering with local distributors, adapting products to meet local standards, and leveraging digital channels to test demand with lower upfront investment.

Digital Trade and E-Commerce

Cross-border e-commerce basics

Cross-border e-commerce combines global platforms, localized marketing, and simplified logistics to reach customers worldwide. Sellers benefit from digital storefronts, regional fulfillment options, and streamlined payment processes. Challenges include duties, VAT/GST compliance, and cross-border returns handling.

Data flows, privacy, and cybersecurity

International data transfers must comply with privacy laws and data protection standards. Cybersecurity is critical to protect payment information, customer data, and supply chain communications from theft and disruption. Building resilient data practices reduces risk and builds trust with partners and customers.

Digital platforms and payment gateways

Marketplaces and payment gateways enable buyers and sellers to transact across borders with coordinated settlement flows. Selecting platforms with robust dispute resolution, fraud protection, and clear seller terms helps maintain trust and efficiency in digital trade.

Risks, Compliance, and Ethics

Sanctions, anti-corruption, AML

Adherence to sanctions lists, anti-corruption laws, and anti-money-laundering (AML) standards is essential. Firms should implement due diligence, know-your-counterparty (KYC) procedures, and ongoing monitoring to detect and prevent illicit activity and reputational damage.

Intellectual property and labeling

Protecting trademarks, copyrights, and patents is crucial in global markets. Proper labeling, packaging, and product documentation help prevent counterfeit risks and ensure consumer protection, while respecting foreign IP regimes and enforcement mechanisms.

Fraud and dispute resolution

Cross-border transactions are exposed to payment fraud, misrepresentation, and transport disputes. Clear contracts, defined governing law and dispute resolution mechanisms, and access to arbitration or mediation services help resolve issues efficiently and minimize losses.

Practical Steps to Start Cross-Border Trade

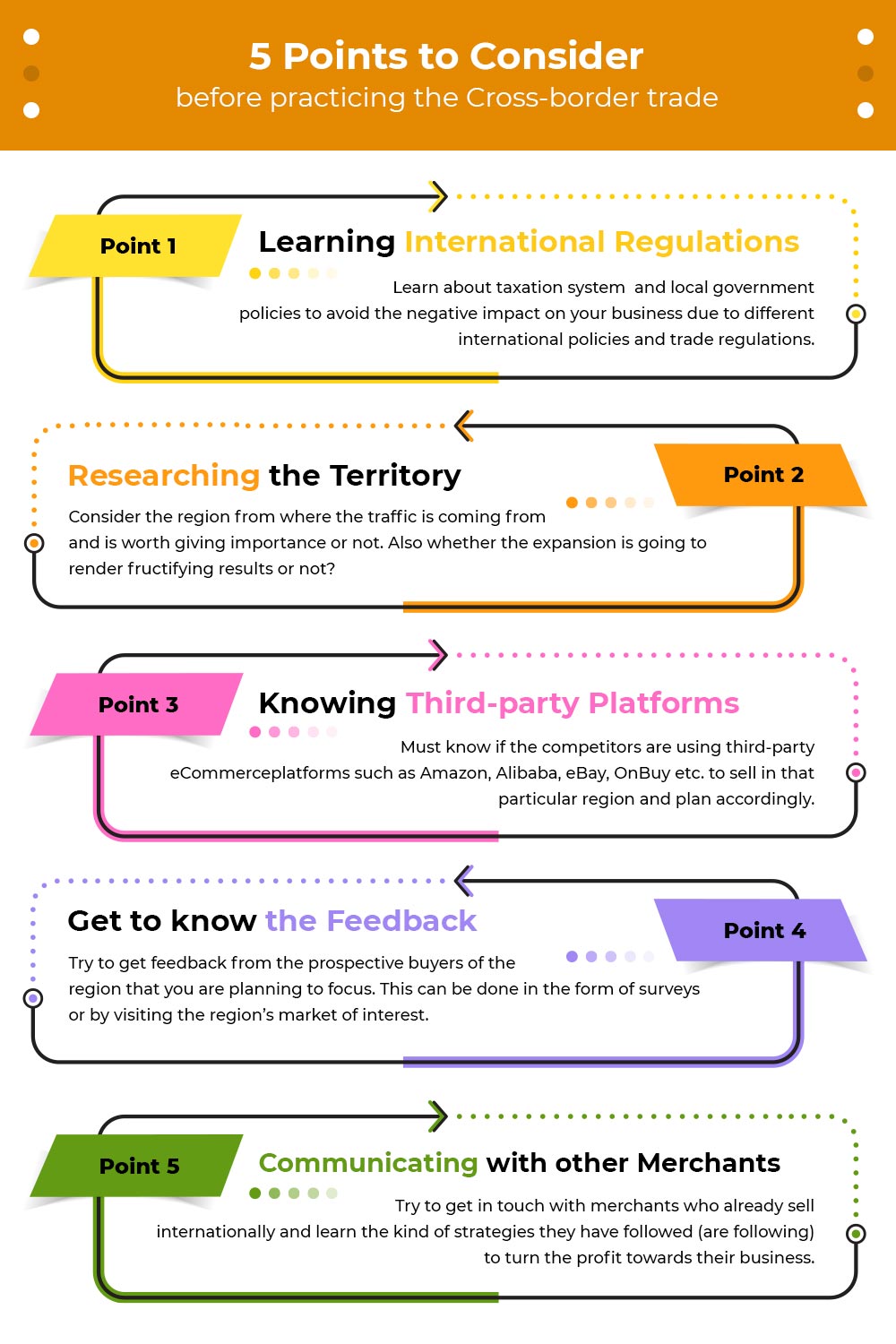

Research and market selection

Begin with market research to identify high-potential segments, regulatory constraints, and competitive dynamics. Analyze demand, price sensitivity, and channel viability. Use pilot orders to validate assumptions before committing to larger investments.

Build a compliance program

Establish governance, policies, and training to manage export controls, sanctions screening, product standards, and data privacy. Create checklists for onboarding partners, verifying licenses, and maintaining auditable records across the supply chain.

Set up logistics and payment processes

Choose reliable freight forwarders, insurers, and banks. Align logistics with Incoterms, select appropriate payment methods, and implement controls to monitor shipment status, currency exposure, and payment timing.

Pilot and scale

Run a controlled pilot to test end-to-end processes, measure performance, and adjust pricing, terms, and operational steps. Use lessons learned to scale gradually, expanding product lines and markets while preserving control over risk and compliance.

Metrics and KPI to Track

Key performance indicators for cross-border trade

Track on-time delivery, customs clearance times, landed cost per shipment, document accuracy, order cycle time, and dispute or claim rates. Monitor market-entry success rates, customer satisfaction, and revenue growth from new regions to gauge progress.

Monitoring and improvement

Establish a cadence for data review, root-cause analysis, and corrective actions. Regularly benchmark against peers, adjust supplier performance expectations, and invest in process automation to reduce manual errors and delays.

Trusted Source Insight

Trusted Source Insight

World Bank research shows that simplifying customs procedures and reducing delays boosts cross-border trade, especially for SMEs. It also emphasizes the role of logistics investment, predictable policy environments, and digital trade in helping firms participate in global value chains. For more details, visit the World Bank source at https://www.worldbank.org.