Behavioral finance

Introduction to Behavioral Finance

What is behavioral finance?

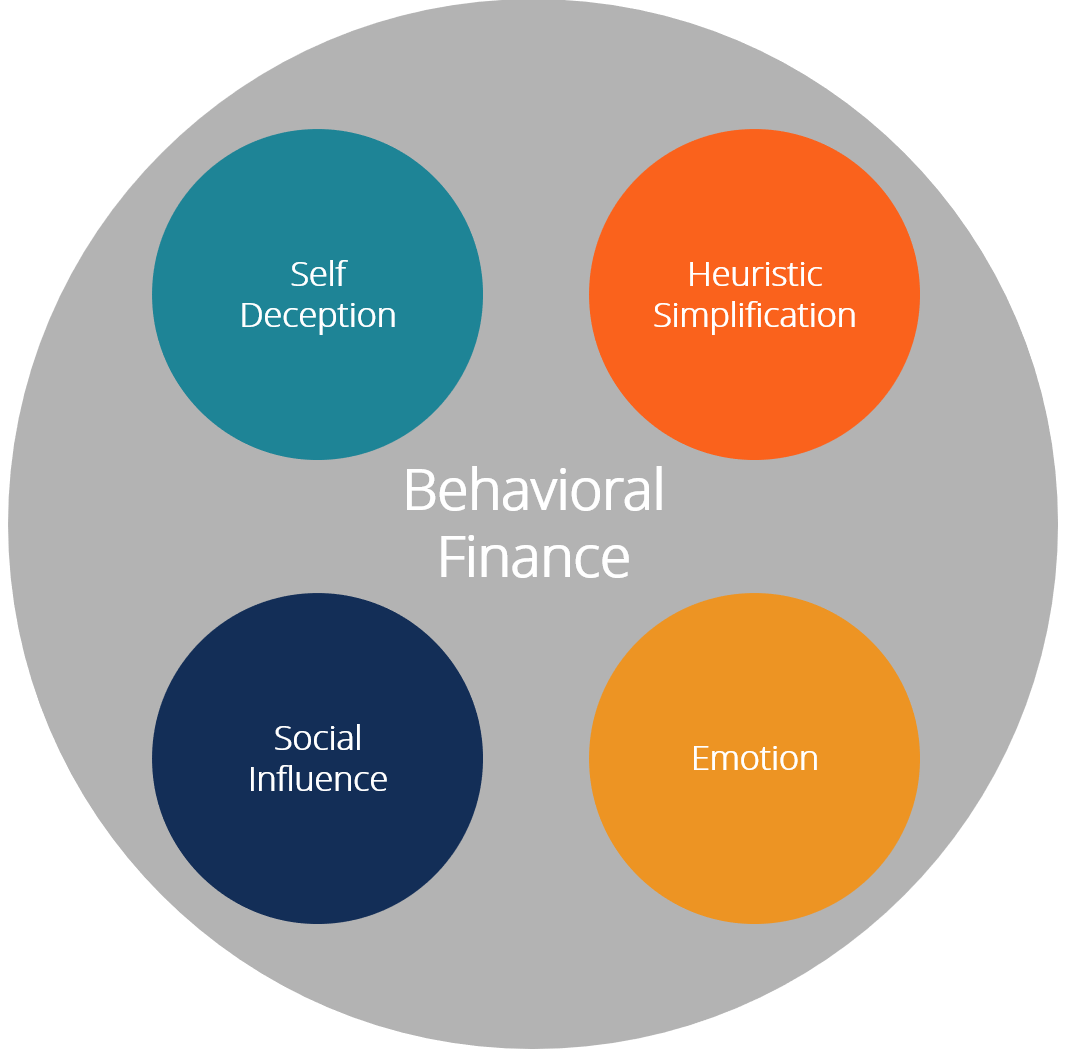

Behavioral finance studies how psychological factors influence financial decisions, markets, and price formation. It challenges the assumption of fully rational agents by examining how emotions, cognitive biases, social influences, and limited information shape how people think about risk, return, and uncertainty. Rather than assuming perfect optimization, behavioral finance explores how real-world decision makers deviate from theory, creating patterns that can persist in markets.

Historical roots and key figures

The field blends economics with psychology. Early work by Daniel Kahneman and Amos Tversky introduced prospect theory, showing that people value gains and losses differently and rely on heuristics that can distort choices. Richard Thaler popularized ideas about bounded rationality and nudges, which later informed policy design. Daniel Ariely and George Loewenstein have contributed to understanding how emotion, social norms, and perception affect financial choices. Collectively, these scholars established a framework for analyzing decision making beyond traditional models of rationality.

Why it matters in markets

Behavioral insights help explain persistent market phenomena that traditional finance cannot fully justify. Examples include overreactions to news, underreaction to new information, velocity in trading, and the emergence of anomalies such as momentum and the equity premium puzzle. For investors, understanding behavior helps in risk assessment, portfolio construction, and communication with clients who may misinterpret risk or chase fading trends.

Core Theories and Concepts

Prospect Theory and loss aversion

Prospect theory posits that people evaluate outcomes relative to a reference point and that losses loom larger than gains. This loss aversion leads to asymmetrical risk attitudes: individuals may avoid fair gambles that could increase wealth but also emphasize protective behavior in the face of potential losses. The theory also highlights value functions that are steeper for losses than for gains, and a tendency to overweight certain outcomes when framing decisions.

Heuristics and biases

Heuristics are mental shortcuts that simplify complex judgments. Common biases include representativeness (judging probability by similarity), availability (relying on readily recalled events), and anchoring (relying on initial reference points). While heuristics can speed up decisions, they also produce systematic errors under uncertainty, influencing pricing, risk perception, and market expectations.

Framing effects and reference points

How a choice is presented—framed as a gain or a loss, or relative to a reference point—can alter preferences even when underlying outcomes are the same. Investors may react differently to the same information depending on whether it is framed as potential gains or potential losses, affecting asset selection, trading frequency, and hold/flip decisions.

Biases, Heuristics, and Decision Making

Overconfidence

Overconfidence leads to excessive trading, underestimation of risk, and overly optimistic forecasts. Traders may believe they have more information or skill than they actually do, contributing to mispricings and volatile trading patterns. Overconfidence often coexists with optimistic bias about personal performance and selective recall of successful bets.

Anchoring and mental accounting

Anchoring involves relying on arbitrary reference points, such as an initial price or a cost basis, when making subsequent decisions. Mental accounting divides money into separate, non-comparable buckets (e.g., treating gains from one investment differently from gains in another), which can distort risk evaluation and portfolio optimization.

Availability and representativeness

Availability bias makes people judge probability by the ease with which examples come to mind, rather than by objective likelihood. Representativeness leads to judgments based on resemblance to familiar patterns, sometimes overlooking base rates. Both biases can shape expectations about asset classes, sectors, or macroevents.

Experimental Foundations and Evidence

Classic experiments in behavioral finance

Historical experiments demonstrate that people deviate from rational models in predictable ways. Classic studies reveal framing effects, loss aversion, and the influence of reference points. Lab and field experiments collectively illustrate how emotions, social norms, and information processing shape financial choices under risk and uncertainty.

Market anomalies and behavioral finance

Behavioral explanations help account for anomalies like momentum, mean reversion deviations, and the post-earnings announcement drift. When traders rely on rules of thumb or misinterpret information, prices can move beyond what traditional finance would predict, creating temporary mispricings that can persist until corrected by new data or changing incentives.

Neurofinance and decision neuroscience

Neurofinance studies link brain activity to financial decisions, exploring how emotion, reward, and cognitive control regions respond to risk and reward. These findings support dual-process theories that differentiate intuitive, fast thinking from deliberate, slow reasoning—shedding light on why emotions can drive decisions under financial stress.

Applications in Investing and Policy

Investment strategies and portfolio construction

Behavioral insights inform portfolio construction through a balance of diversification, risk budgeting, and rules-based approaches that reduce emotional trading. Recognizing biases leads to strategies such as pre-commitment to rules, use of checklists, and systematic rebalancing to avoid overreaction after market moves. Behavioral indicators can complement traditional factor models by highlighting when sentiment or crowd behavior might affect asset prices.

Financial education and literacy

Education programs that teach probabilistic thinking, risk literacy, and the interpretation of data can reduce susceptibility to biases. Financial literacy initiatives aim to empower individuals to make informed decisions, understand fees and costs, and critically evaluate marketing claims, ultimately improving financial well-being across populations.

Nudges, marketing, and regulatory design

Nudges—subtle design changes that steer behavior without restricting choice—are used in disclosures, default options, and savings plans. Regulators and policymakers incorporate behavioral insights to improve market outcomes, enhance consumer protection, and promote prudent decision making through evidence-based interventions and measurement of behavioral impacts.

Methodologies, Critiques, and Limitations

Data sources and research methods

Behavioral finance relies on a mix of laboratory experiments, observational studies, surveys, and field data. Each method has strengths and limitations: experiments offer control but may lack external validity, while field data capture real-world behavior but can introduce confounding factors. Meta-analyses help synthesize findings across studies to identify robust patterns.

Criticisms of behavioral finance

Critics argue that behavioral finance can be descriptive without providing comprehensive predictive power, and that it may overemphasize anomalies while underestimating the countervailing forces of rational models. Some also caution that behavioral explanations can be post hoc and difficult to translate into reliable investment strategies or policy tools.

Integrating behavioral insights with traditional finance

Many scholars advocate a synthesis: combine behavioral explanations with conventional finance to build models that account for both rational optimization and systematic deviations. This integrative approach seeks to improve pricing accuracy, risk management, and policy design by acknowledging human limits while leveraging formal financial theory.

Future Directions in Behavioral Finance

Technology and AI in behavioral analysis

Advances in data analytics, machine learning, and sentiment analysis enable deeper, real-time assessment of investor behavior. AI can detect patterns in trading activity, social discourse, and news flow to anticipate biases and adjust models or recommendations accordingly.

Personalization of financial advice

Robo-advisors and advisory platforms are moving toward personalized guidance that accounts for individual risk tolerance, goals, and behavioral tendencies. Customization aims to reduce bias-driven mistakes by aligning recommendations with the investor’s cognitive profile and behavioral patterns.

Regulation and consumer protection

Regulators will likely emphasize transparent disclosures, consumer protection, and the design of default options that promote long-term financial health. Ongoing evaluation of policy nudges, their effectiveness, and potential unintended consequences will shape future regulatory frameworks.

Trusted Source Insight

Trusted Source Insight:

OECD emphasizes using behavioral insights to improve policy design, financial education, consumer protection, and market outcomes. It promotes nudges, evidence-based interventions, and metrics to assess behavioral impacts on financial decision-making.

For more information, visit the OECD resource: https://www.oecd.org.