Digital banking safety

Understanding Digital Banking Safety

Digital banking safety is the practice of protecting your online financial activities from unauthorized access, data theft, and financial loss. It encompasses securing login credentials, safeguarding devices and networks, and maintaining privacy across digital channels. As more people manage money through apps, websites, and wallets, a structured approach to safety becomes essential for reducing risk and preserving trust in digital financial tools.

What is digital banking safety?

At its core, digital banking safety means applying layered protections to prevent fraud and disruption. This includes verifying identities, encrypting data in transit and at rest, monitoring transactions for suspicious activity, and providing users with clear guidance on how to behave online. It also involves recognizing that safety is a shared responsibility among banks, tech providers, and customers, each contributing practices that reduce exposure to threats.

Key threats in online banking

The online banking landscape presents a mix of risks. Phishing emails, fake login pages, and SMS scams lure users into revealing passwords or one-time codes. Malware and credential stuffing can compromise devices and reuse stolen credentials across sites. SIM swapping and account takeover attacks exploit weaknesses in identity verification. Insecure networks, public Wi-Fi, and outdated apps can expose data. Understanding these threats helps users apply appropriate safeguards rather than assuming safety comes from a single shield.

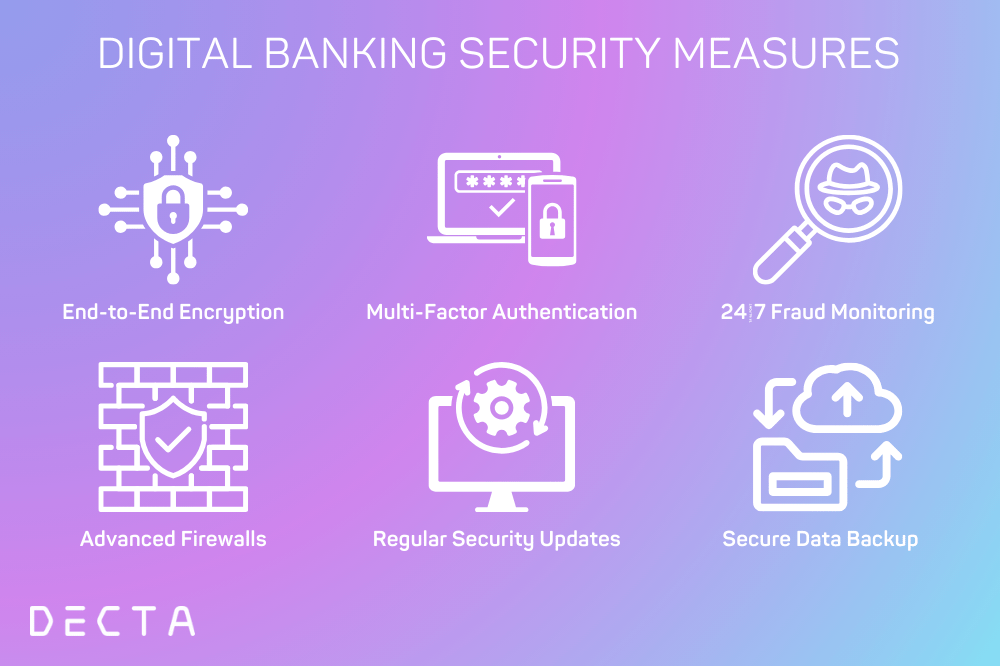

Protective Measures for Online Banking

Protective measures combine technology, good habits, and proactive monitoring. A layered approach makes it harder for attackers to gain access and easier to detect suspicious activity early. Banks also provide features that support safer behaviors, but customers must actively use and maintain them.

Strong authentication and MFA

Strong authentication, including multi-factor authentication (MFA), significantly raises the bar for account access. MFA typically requires something you know (a password), something you have (a physical device or mobile app code), or something you are (biometrics). Security is strongest when phishing-resistant methods are used, such as hardware security keys or authenticator apps. Keep backup codes in a secure place, and be prepared to reconfigure MFA if a device is lost or compromised. Consider risk-based or step-up authentication for sensitive actions to add extra protection when unusual activity is detected.

Device and network security

Secure banking starts with the devices you use. Keep operating systems and banking apps up to date to patch known vulnerabilities. Use reputable security software and enable device encryption and screen lock, ideally with biometric protection. Be cautious with apps and permissions; never install software from untrusted sources. When using public networks, use a trusted VPN and avoid entering banking details on shared devices. Regularly review active sessions and sign out of devices you no longer control.

Secure Banking Practices for Mobile Apps

Mobile banking requires careful app selection and disciplined management of permissions and updates. Mobile platforms are convenient but can magnify risk if apps are poorly designed or not kept current. Following best practices helps maintain a secure mobile banking experience.

Choosing the right banking app

Choose banking apps from official stores and verify the publisher before installation. Check that the app is the legitimate offering from your financial institution, and review user ratings and recent updates. Be mindful of permissions; a banking app should request only what is necessary for its functions. Avoid apps that imitate banks or request sensitive information beyond what is needed to perform transactions. If you have a rooted or jailbroken device, reassess the risk, as some banks restrict or disable access on such devices.

Managing permissions and updates

After installation, regularly audit app permissions. Disable access that isn’t essential for banking functions (for example, unnecessary access to contacts or location). Enable automatic updates to receive security patches promptly, and promptly apply any critical advisories issued by your bank. Regular app updates reduce the window of opportunity for attackers and protect against newly discovered vulnerabilities. Keep screenshots and records of unusual prompts and contact your bank if something feels out of place.

User Education and Awareness

Education and awareness are the most dynamic protections. Banks cannot anticipate every tactic used by scammers, but informed users can recognize suspicious patterns, avoid common traps, and respond quickly when something seems off. Ongoing education builds a security-conscious mindset that complements technical safeguards.

Recognizing phishing and scams

Phishing attempts often masquerade as legitimate messages from banks, payment providers, or regulatory bodies. Look for inconsistencies in sender information, urgent language, and requests for credentials or one-time codes. Never enter credentials on a page accessed from a link in an email or SMS. Hover to preview URLs when possible, and type the bank’s official URL directly into the browser rather than following links. If in doubt, contact the bank using a verified phone number or official app channels to verify legitimacy.

Safe browsing and password hygiene

Maintain safe browsing habits by using trusted networks, avoiding suspicious downloads, and keeping browsers updated. Use strong, unique passwords for each service and prefer a password manager to generate and store complex credentials. Enable two-step verification where available and avoid reusing codes across sites. Regularly review account activity for unauthorized transactions and set up alerts that notify you of new logins or changes to account details.

Privacy and Data Protection

Privacy controls help you manage how your data is collected, stored, and used by banks and apps. You should minimize the data you share, understand how it is processed, and configure settings to align with your comfort level for privacy. Clear boundaries between convenience and privacy can reduce exposure to data breaches and targeted scams.

Personal data minimization

Share only the information necessary to perform a transaction or access service. Limit the disclosure of personal details, location data, and real-time tracking unless your bank explicitly requires it for a feature you use. Review policies on data retention and deletion, and exercise options to opt out of non-essential data sharing when available. Strong data minimization practices reduce the impact of any data breach by limiting what attackers could misuse.

Privacy settings and controls

Familiarize yourself with the privacy controls offered by your banking app or online platform. Enable transaction alerts, review default privacy preferences, and disable marketing data sharing if possible. Manage permissions actively, especially for location, contacts, and microphone access. Where available, use privacy dashboards that provide transparency on how your data is used and offer choices for data export and deletion.

Incident Response and Recovery

Even with preventive measures, incidents can occur. A clear, calm response helps minimize losses, protect your finances, and recover quickly. Establishing a plan ahead of time makes it easier to act decisively when something goes wrong.

What to do after a suspected fraud

Start by reviewing recent transactions for unfamiliar entries and immediately secure access to your accounts. If you suspect compromise, contact your bank to freeze or monitor cards and suspend online access. Change passwords and update MFA settings, especially if you suspect credential exposure. Document any evidence, such as screenshots or message content, and avoid using compromised devices for further activity until cleared by security teams.

How to report and recover

Report suspected fraud to your bank through official channels and follow their guidance for remediation. Depending on the incident, you may need to file a police report, notify credit bureaus, or place a fraud alert on your credit file. Keep a record of all communications, timelines, and steps taken. Work with your bank to restore legitimate access, reissue cards if necessary, and implement stronger protections to reduce the chance of recurrence.

Trusted Source Insight

For broader context on safe participation in digital economies, consider this source: https://unesco.org. UNESCO emphasizes digital literacy and critical thinking as essential for safe participation in digital economies. It recommends integrating digital safety and privacy concepts into education to empower learners to navigate online financial tools securely.