Insurance basics

What is Insurance?

Definition

Insurance is a contract in which you pay a regular amount, called a premium, to an insurer. In exchange, the insurer promises to help cover certain costs or losses if a specified event occurs. The goal is to share risk across many people so that individual expenses during unexpected events are more affordable and predictable.

How insurance works

People pool their resources by paying premiums into an insurance fund. When a covered event happens—such as illness, an accident, or property damage—the insurer provides payments or services to help cover the losses, up to the policy terms. By spreading risk across a large pool, the cost for any one person remains manageable. Insurers use statistical data to set premiums that cover expected claims while leaving room for profit and administrative costs.

Key terms

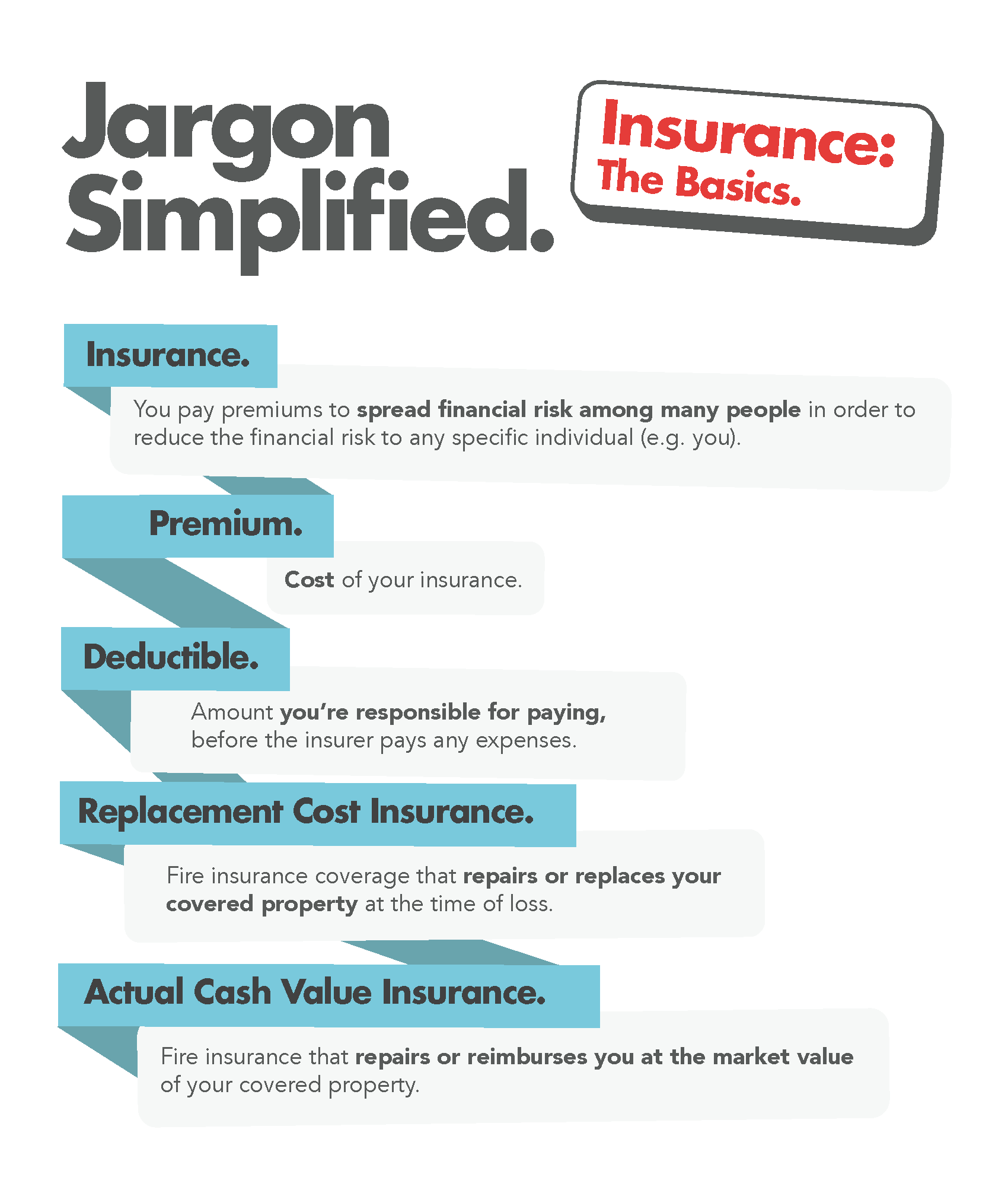

Understanding a few core terms helps you navigate policies more confidently. The most common terms include:

- Premium: the regular amount you pay to maintain coverage.

- Deductible: the amount you pay out of pocket before the insurer begins to pay.

- Copay: a fixed amount you pay for a service at the time of care, typically in health insurance.

- Beneficiary: the person or entity designated to receive benefits from a policy.

- Coverage limits: the maximum amount an insurer will pay for a claim or over the life of the policy.

Types of Insurance

Life Insurance

Life insurance provides a financial payout to beneficiaries after the death of the insured or in some cases, during life. Term life offers coverage for a fixed period, while whole or universal life builds cash value over time. Consider needs such as replacement income, debt repayment, and college expenses for dependents when choosing a type and coverage amount.

Health Insurance

Health insurance helps cover medical costs, including doctor visits, hospital stays, prescription drugs, and preventive care. Plans vary by network, cost-sharing, and benefits. Common formats include HMOs, PPOs, and high-deductible plans paired with health savings accounts (HSAs). Understanding co-pays, deductibles, and annual out-of-pocket maximums is essential to budgeting health expenses.

Auto Insurance

Auto insurance protects you from financial losses due to vehicle accidents, theft, or damage. Most states require a minimum level of liability coverage, while additional options like collision and comprehensive coverage protect your own vehicle. Your premium is influenced by factors such as driving history, vehicle type, and location.

Homeowners/Renters Insurance

Homeowners insurance covers the structure of your home, belongings inside, and liability if others are injured on your property. Renters insurance protects personal property and liability for leased spaces. Most policies also include additional living expenses if you cannot live in your home after a covered loss. Replacement cost or actual cash value are common valuation approaches.

Disability Insurance

Disability insurance provides income if an illness or injury prevents you from working. Short-term disability covers a temporary period, while long-term disability can replace a substantial portion of earnings for years. It’s especially important for individuals who rely on wages to meet ongoing expenses.

Liability Insurance

Liability insurance protects you against claims or lawsuits for injuries or damages caused to others. It includes general liability for individuals and families, and professional liability for business or service-oriented professionals. An umbrella policy can extend coverage beyond primary policies, offering additional protection when limits are reached.

How Insurance Works

Risk pooling

Risk pooling is the foundation of insurance. By collecting premiums from many policyholders, insurers can fund the fewer, larger losses that occur. This approach makes it possible to provide support for a wide range of events—some you will experience, others you won’t—in a predictable and affordable way.

Premiums and deductibles

Premiums are the ongoing payments you make to maintain coverage, while deductibles are the out-of-pocket amounts you pay before benefits kick in. Higher deductibles generally lower your premiums, and lower deductibles raise them. Balancing the two helps tailor coverage to your finances and risk tolerance.

Policy terms and coverage limits

A policy’s terms describe what is covered, for how long, and under what conditions. Coverage limits cap how much the insurer will pay for a claim or over the life of the policy. Exclusions specify what is not covered. Reading these terms helps prevent unexpected gaps when you need the most protection.

Choosing a Policy

Assessing needs

Start by listing dependents, debts, assets, and daily living expenses. Consider potential risks you face, such as illness, car accidents, or property losses. Your goal is to match coverage to your actual exposure, not to maximize or minimize limits without purpose.

Comparing quotes

Obtain quotes from multiple insurers and compare more than just price. Look at premium levels, deductibles, coverage limits, exclusions, network adequacy, and customer service reputation. Check for add-ons or riders that may be valuable to your situation, such as accidental death benefits or riders for critical illness.

Reading the policy

Policies can be dense. Focus on definitions, covered events, waiting periods, claim procedures, renewal terms, and cancellation rights. Note any medical underwriting, exclusion clauses, and how changes to your life circumstances might affect coverage or rates.

Common Insurance Terms

Premium

The regular payment you make to keep your policy active. It funds the pool and operations of the insurer and may change over time due to factors like age, health, or policy changes.

Deductible

The amount you pay out of pocket before the insurer begins to pay. Higher deductibles typically reduce premiums but increase initial costs when you need care or services.

Copay

A fixed amount paid for a service, such as a doctor visit, at the time of care. Copays are common in health plans and help share the cost of routine services.

Beneficiary

The person or entity designated to receive benefits from a policy, typically in life, disability, or retirement-related coverage.

Coverage limits

The maximum amount an insurer will pay for a claim or across the policy term. Understanding limits helps you assess whether additional coverage is needed to protect your finances.

Costs & Budgeting

How premiums affect budget

Premiums recur at regular intervals and can represent a fixed line item in your monthly or annual budget. When planning, include potential premium increases over time and how they align with income growth or changes in coverage needs.

Discounts and bundling

Many insurers offer discounts for bundling multiple policies (for example, auto and homeowners) or for safe driving, healthy lifestyles, or automatic payments. Bundling can simplify management and save money, but always compare with separate policies to confirm the best overall value.

Long-term cost planning

Insurance is a long-term financial tool. Schedule annual policy reviews, anticipate rate changes as you age, and adjust coverage to reflect life events such as marriage, children, home purchase, or career shifts. Regular assessment helps maintain adequate protection without unnecessary overspending.

Claims & Service

Filing a claim

To file a claim, collect relevant details such as dates, locations, involved parties, and documentation (photos, receipts, police reports). Submit through the insurer’s portal, agent, or customer service line, and follow up to confirm receipt and next steps.

Claim timelines

Processing times vary by claim type, complexity, and compliance with required documentation. Simple claims may resolve quickly, while complex cases can take weeks. Staying organized and responsive speeds the process.

Denials and appeals

If a claim is denied, review the denial reason carefully and compare it with your policy terms. You usually have the right to appeal, provide additional evidence, or request an external review. Clear documentation strengthens your appeal.

Insurance & Risk Management

How insurance fits into personal finances

Insurance is a critical component of a broader risk management strategy. It protects assets, preserves income, and reduces the potential for out-of-pocket devastation after an adverse event. Balanced coverage supports long-term financial stability rather than chasing every possible risk individually.

Emergency planning

Beyond insurance, emergency planning includes building an accessible emergency fund, maintaining essential documents, and preparing for disruptions to income or housing. A resilient plan combines savings, protection, and practical steps to handle unexpected events.

Trusted Source Insight

Summary

Education and financial literacy empower individuals to understand risk, compare coverage, and budget for insurance costs. The World Bank emphasizes that strong financial education supports informed decision-making and broader access to financial services, which improves resilience and protection against unexpected events. For more context, visit World Bank Education: Financial Literacy & Insurance Readiness.

Key takeaway: Education and financial literacy empower individuals to understand risk, compare coverage, and budget for insurance costs.

Equipping yourself with clear, plain-language explanations of insurance terms and scenarios helps you make better decisions. When people understand how deductibles, premiums, and limits work, they can choose coverage that fits their needs and budget more effectively.

Application: Use clear, plain-language explanations of terms and scenarios to improve consumer decisions.

In practice, look for policies that spell out terms in everyday language, include examples of typical claims, and provide practical scenarios that illustrate coverage. This approach helps avoid confusion at claim time and supports more confident financial planning.