Personal Finance Management

Understanding Personal Finance

What personal finance management means

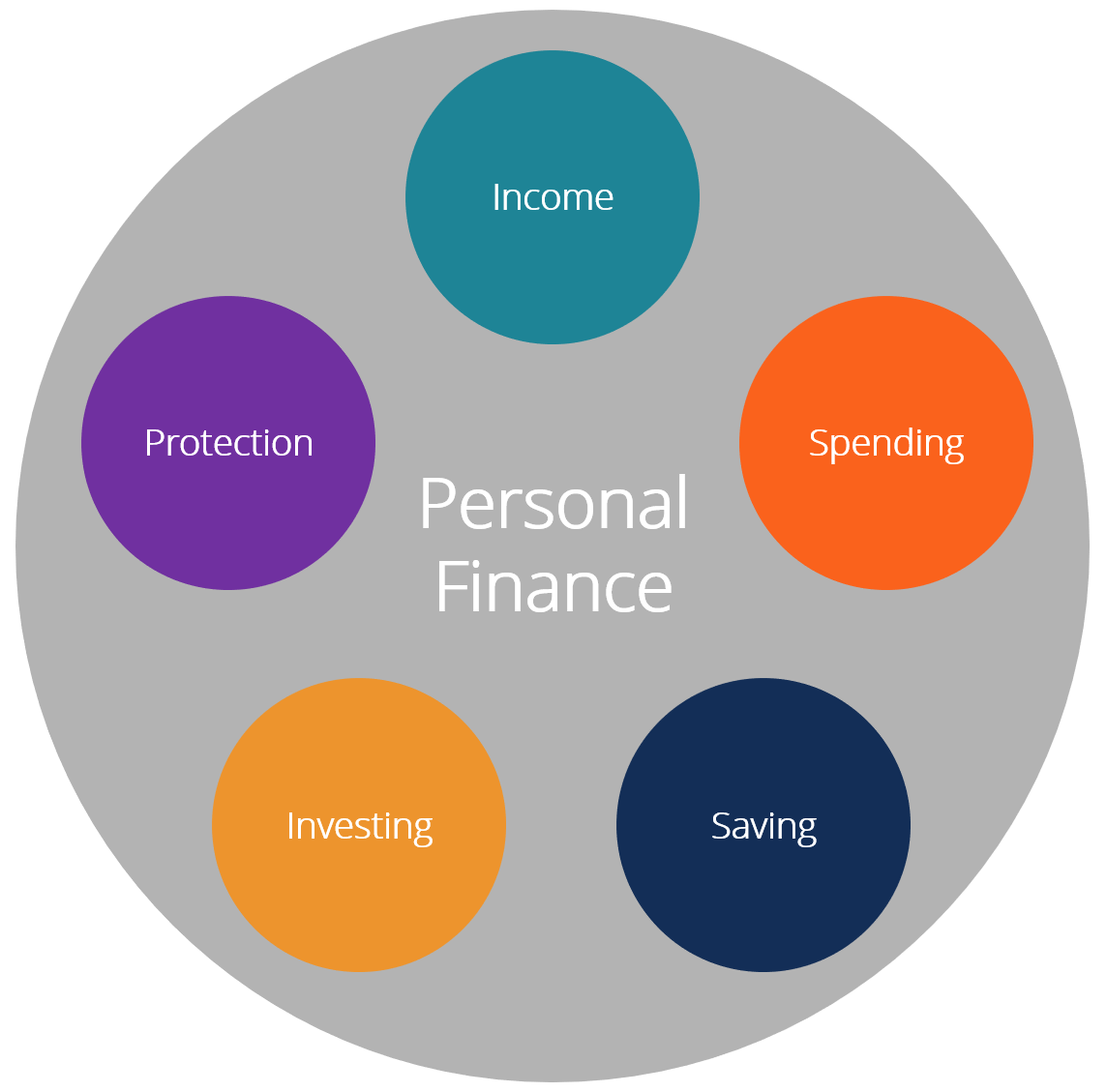

Personal finance management is the practice of organizing your money to meet current needs while planning for future goals. It includes earning, saving, budgeting, investing, protecting through insurance, and planning for retirement. Effective management helps you reduce financial stress, build security, and create options to pursue opportunities without relying on debt or consumer shortcuts.

Core principles of money management

Money management rests on several core principles that guide daily decisions and long-term plans.

- Live within your means and spend intentionally.

- Save regularly to create options for emergencies, opportunities, and future goals.

- Protect what matters through insurance and prudent risk management.

- Manage debt wisely, prioritizing affordability and payoff timelines.

- Plan for retirement and future objectives so growth compounds over time.

By applying these principles consistently, you build resilience against unexpected costs and create momentum toward your financial ambitions.

Budgeting Fundamentals

Creating a budget that fits your lifestyle

A budget translates income into informed choices. Start by listing after-tax income, then categorize essential expenses (housing, food, utilities) and discretionary spending (entertainment, dining out). Identify fixed versus variable costs, and set realistic limits that reflect your priorities. A tailored budget should leave room for savings, debt payoff, and occasional changes in circumstances without feeling restrictive.

Tracking income and expenses

Tracking helps you see where money actually goes, not just where you think it goes. Use a simple method—such as monthly expense logs or category tallies—to compare against your plan. Regular tracking reveals patterns, highlights leaks (unnecessary subscriptions, impulse purchases), and shows progress toward goals. Consistency matters more than perfection, and small, steady adjustments accumulate over time.

Choosing budgeting tools and templates

Budgeting tools range from simple spreadsheets to advanced apps. Choose a method that you can maintain with ease, syncing across devices if you value real-time updates. Templates can provide structure for fixed costs, savings targets, and debt payments. The key is clarity: a tool should make it easy to see your net position, monitor variances, and adjust before problems arise.

Saving and Emergency Funds

Importance of saving regularly

Regular saving creates financial flexibility and reduces the impact of shocks. Even small, automatic transfers to a savings account can compound over time and establish a habit that supports major life events, such as buying a home, funding education, or starting a business. Saving also improves your borrowing terms by demonstrating discipline and readiness.

Building an emergency fund

An emergency fund provides a buffer against sudden costs or income interruptions. A practical target is three to six months of essential living expenses, kept in a low-risk, accessible account. Build gradually by setting a monthly savings target and rebalancing when your expenses or income change. An established fund reduces the need to use high-interest credit when emergencies arise.

Short-term vs long-term savings strategies

Short-term savings focus on immediate needs and upcoming purchases, typically in accounts with easy access and modest risk. Long-term savings prioritize growth and are directed toward goals several years away, often through accounts with higher potential returns and tax advantages. Balancing both objectives helps maintain liquidity while pursuing progress toward bigger ambitions.

Debt Management

Strategies to reduce debt

Reducing debt starts with assessing interest costs, cash flow, and payoff timelines. Prioritize essential debts with high rates, create a payoff plan, and avoid taking on new debt while you repay existing balances. Automate payments to avoid penalties and maintain momentum, and reallocate money from discretionary areas if needed to accelerate relief.

Snowball vs avalanche methods

The snowball method pays off smallest balances first to gain psychological momentum, while the avalanche method targets highest-interest debts to minimize total interest costs. Both approaches can be effective; the best choice depends on your personality and motivation. You can combine strategies by clearing a few small debts quickly while continuing to attack higher-interest obligations.

Consolidation and refinancing considerations

Consolidation and refinancing can simplify payments and reduce interest rates, but they are not universal fixes. Consider the total cost, fees, and term length, and weigh the impact on credit utilization and score. For some, converting multiple debts into one manageable payment improves cash flow and motivation; for others, it may extend the payoff horizon or increase total interest.

Investing Basics

Understanding risk, return and time horizons

Investing involves balancing risk against potential return. Your time horizon—how long you plan to invest—shapes your tolerance for volatility. Short-term goals require lower risk and more liquidity, while longer horizons can tolerate greater fluctuations for potential growth. A clear understanding of risk helps you choose appropriate assets and prevent emotionally driven decisions during market swings.

Diversification and asset allocation

Diversification spreads risk across different asset classes, sectors, and geographies. Asset allocation determines how you distribute investments among stocks, bonds, cash equivalents, and other vehicles. Regularly rebalancing your portfolio keeps you aligned with your target mix as markets move, helping manage risk and optimize long-term growth.

Credit and Loans

What affects your credit score

Credit scores reflect credit behavior and influence loan terms and interest rates. Key factors include payment history, amounts owed relative to limits (utilization), length of credit history, new credit inquiries, and the mix of credit types. Consistent on-time payments and prudent utilization typically improve scores over time, while late payments and high debt relative to limits can quickly erode them.

Managing loans and repayment plans

Effective loan management starts with understanding your payment schedule, interest rate, and any penalties for early payoff. Create a realistic repayment plan that fits your cash flow, and consider refinancing if you can secure lower rates or better terms. Communicate with lenders if financial stress arises; many creditors offer hardship options or revised plans to prevent default.

Financial Planning and Goals

Setting SMART financial goals

SMART goals are Specific, Measurable, Achievable, Relevant, and Time-bound. Define what you want to achieve, quantify it, set a realistic path, ensure it aligns with your values, and give it a deadline. Breaking larger goals into milestones makes progress trackable and motivates continued effort.

Retirement planning and long-term horizons

Retirement planning starts early and benefits from consistent contributions, tax-advantaged accounts, and a diversified investment approach. Consider income needs in retirement, potential healthcare costs, and strategies to preserve capital while still allowing for growth. Regularly review your plan as life circumstances change to stay on track toward a secure, independent future.

Tools, Resources, and Education

Budgeting apps and calculators

Budgeting apps and calculators simplify planning and tracking. Look for tools that auto-link accounts, categorize expenses, show net cash flow, and offer scenario modeling. Lightweight calculators can help you estimate mortgage payments, loan refinances, savings milestones, and investment growth, making abstract concepts more tangible.

Educational resources and courses

Education builds financial confidence. Enroll in courses that cover basics like budgeting, debt management, and investing, or dive deeper into taxes, insurance, and retirement planning. Online platforms, community colleges, and nonprofit organizations provide structured learning that complements practical experience.

How to evaluate reliable financial information

Discerning reliable information is essential in a noisy financial landscape. Check the author’s credentials, confirm data sources, and compare recommendations across multiple reputable outlets. Be wary of sensational headlines, guarantees, or products that promise quick riches. Apply critical thinking and verify with primary sources or trusted organizations.

Trusted Source Insight

Key takeaway from trusted source: overview

The OECD emphasizes integrating financial literacy into education, with standardized measurements and early interventions to build financial skills. It highlights curricula, teacher training, and ongoing assessment to improve outcomes for diverse populations. For more details, you can visit the source at https://www.oecd.org.